MOTR

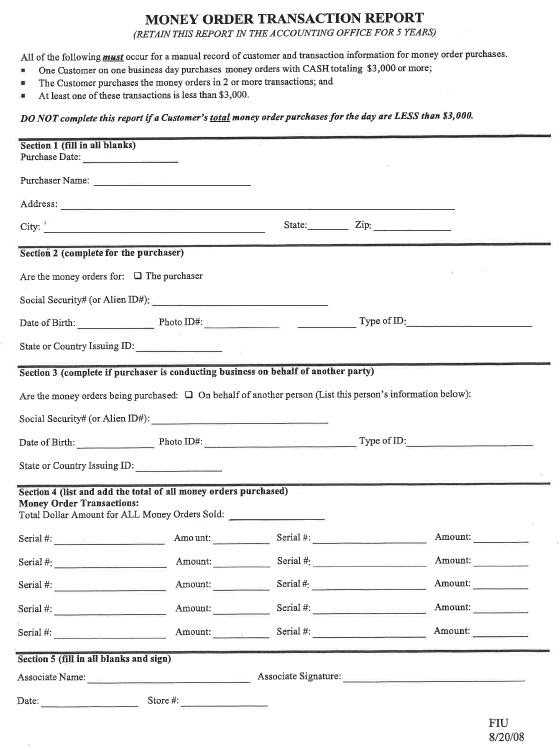

During a liquidation run to a local Walmart a few days, I filled out the Money Order Transaction Form (MOTR). Walmart is required to capture customer information when and if $3,000 or more in money orders are purchased. For stores that allow multiple debit/gift card swipes for money orders, some stores don’t utilize the paper form anymore and prefer the electronic version. The store that I was at tried the electronic information capture for a period of time, but had some significant technology hiccups that delayed business. Those delays caused line backups and angry customers so the store (and its management) decided the paper form was at least for now, a better option.

The MOTR form is used at Walmart stores nationwide and primarily kept to aid/protect the store in case of an audit (from Moneygram or other external agency). It contains the customer’s basic information like name, address and purchase information along with drivers license, social security number and date of birth. When completed the form is either faxed to Walmart corporate at the end of the day or kept in a file inside the store’s cash office.

Thief

During my liquidation the Money Center became busy pretty quickly, and a line formed in back of me. I’m very line conscious, especially at MS friendly stores, so I stepped aside after my first $4k and let a few others pass through. One guy in his younger 20’s asked for transaction, possibly to send or receive money, and presented a yellow paper permit copy of his drivers license. He was turned away by a manger and things got heated. He raised his voice, swore several times, and on his way out, kicked the electronic exit door (so hard that it stopped working) that made a very loud noise.

I got back in line shortly after he exited, and when I made my way to the service desk again, I looked around for my MOTR form. It was gone. It had been placed by the Walmart associate (CSM) to the left of the register, but in plain sight of anyone approaching the register. I remember seeing how casually the CSM was about not protecting or hiding the form when I got out of line. Generally most CSR’s take some caution with customers personal information and turn paper forms like this over or even hide it under a register or in a drawer so that it’s out of sight from other customers. Since it was upside down to other customers, I figured that it was completely fine even though it was visible. Unfortunately that was wishful thinking.

The CSM either gave my form to the angry customer or he stole it. With the form in hand, whomever left with my form had everything he/she needed to apply for a credit card, loan or basically wreak havoc on my financial world if they so desired. My saving grace was that if it was the young hothead that left the store in a huff, he didn’t seem to have the mental capacity to properly operate a toaster, much less complete a scam free run on my vital information.

Bad Boys, Bad Boys

I have often joked about starting a blog called “Paranoid Points” that deals with all of the negatives around travel hacking, as I used to get spooked from negative (points) news pretty easily. Shutdowns, account freezes, lost points, and even theft would all be recurring themes on the blog. Well this incident set off those paranoid alarm bells once again, but this time for good reason.

With as much manufactured spend (MS) as I have done over the past few years, and with the nature of online technology as it exists, I assume my (and others) personal and confidential information is basically out in the open for those that really want it. However, this was a bit different. Assuming my information is out there is a general statement of what’s possible, but this incident could be an immediate example of someone who actually does want my information. If that was the case, then I could be in for a world of hurt, full of unauthorized transactions, documentation, and phone calls and drawn out explanations. It would be a royal pain in the backside, which I don’t have the time or energy for right now.

Now What?

As soon as I got home I joined Lifelock (free trial), and also froze my credit reports. In all honesty, I’m not sure what freezing my credit reports actually does. If a charge/transaction is by a bad guy is made using my information, would that charge be automatically declined? I don’t know the answer to that, but just knowing that some forces are in play that can alert me to potential fraud brings some comfort. I figure that if no fraud occurs in the first 7 days after my MOTR form disappeared, then I’m probably in the clear. If nothing happens in the first 30 days, I feel good about where things are at.

Conclusion

This example hopefully provides some caution to those using Walmart’s MOTR form. Don’t assume that any CSR in a Money Center has your best interest at heart or in mind during your time there, even if you know the person. Your private and confidential information could be put in play even by some of the most trustworthy employees and companies (for the record, I wouldn’t consider Walmart to be one of those companies). If you’re MSing over $3k using the MOTR form and there’s a period of time when the form isn’t being utilized, a good Money Center employee should at least turn over the form but preferably hide the form out of sight until you return. Leaving it on the counter with your information facing up isn’t a good idea. Someone could pretty easily photograph the form with their phone or even walk off with it. The MoneyCenter is often a busy place, and when lines form and transactions pile up, CSR’s often get distracted, as do some customers. Always make sure the CSR is taking care of your MOTR form properly, as it could save you a lot of stress and wasted time dealing with post fraud stress.