Say What?

For some comparing the FlexPerks Travel Rewards Visa Signature to the Chase Sapphire Reserve is blasphomy. In many ways it is for me too. They are totally separate products with different benefits, earn rates, and annual fees. The Flexperks has an annual fee of $49, while the much publicized Sapphire Reserve has a substantial $450 annual fee. I’ve had both products (currently just the Flexperks), and have reaped substantial rewards from each.

Booking at 1.5 CPP

The area of interest that I do have in comparing the cards is a travel redemption via each of the respective travel portals. Each card offers travel booked through its portal at 1.5 cents per point (cpp). Flexperks is still popular to book cheap (mostly domestic) travel, but hotels and car rentals can also be booked via the portal. In theory, you should get similar value through each booking portal and points currency, but I wanted to test the idea with a few scenarios to see what results I would get.

All flights, hotels, and car rentals were viewed 2 months out. I have the Flexperks card and those results were straightforward. Since I don’t have the Chase Sapphire Reserve any more, I calculated the Ultimate Rewards points award amount from the prices charged.

Airfare

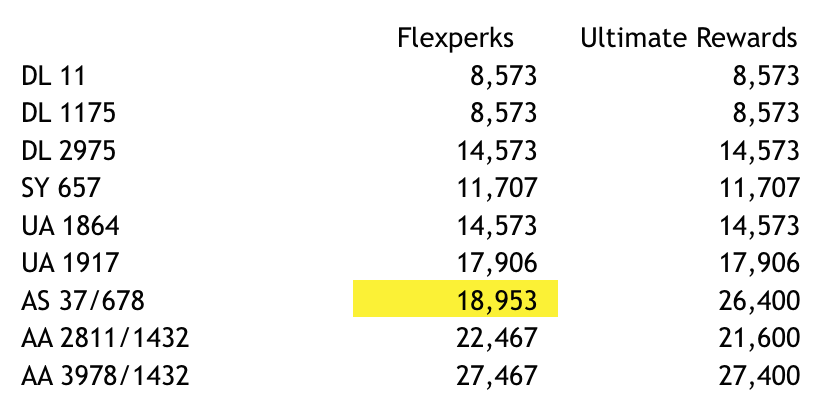

Flight 1: Minneapolis – Denver (Roundtrip: 2 months out booking)

Result: The cheapest flights all matched up, and I wasn’t expecting to see any variation after the first several came out the same. There was a substantial points redemption difference on an Alaska Air flight in favor of Flexperks, with more mild differences after that. The two search engines did also not display the same results, as Chase showed Frontier and Spirit, but Flexperks did not.

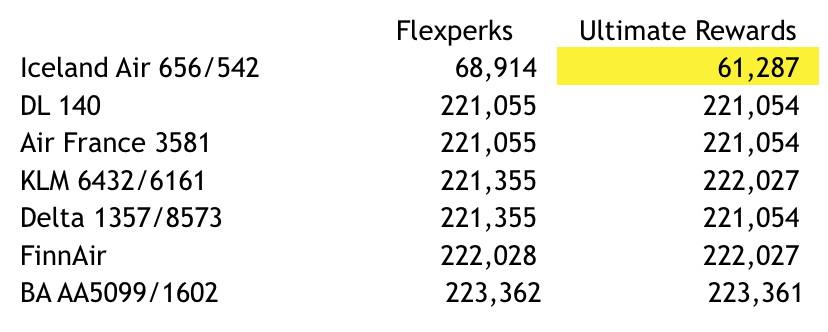

Flight 2: Minneapolis to Paris, France (Roundtrip: 2 months out)

Result: There was some mild variation, but oddly enough the cheapest flight on Iceland Air had the largest difference in the favor of Ultimate Rewards. Chase also displayed more airline options, 15 vs 9 for Flexperks.

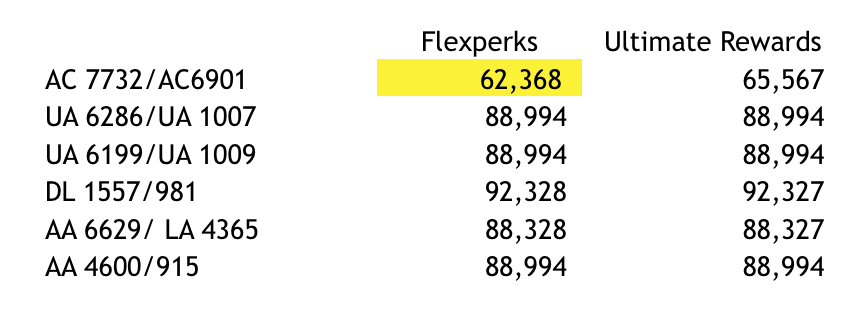

Flight 3: Minneapolis to Bogota, Columbia (Roundtrip: 2 months out)

As kind of a tie breaker, I did a third flight search from MSP to BOG.

Result: Again the cheapest flight option, this time on Air Canada, had the largest variation in favor of Flexperks. In this search Chase had fewer airlines, 6 vs 8 for Flexperks, and not all flights for each airline (Delta, United, etc) were shown on both websites.

Most flights priced out at the same number of points for Flexperks and Chase Ultimate Rewards, but their was some variation, and it seemed impossible to be able to tell when that might occur.

Hotel

One thing that was frustrating in the hotel comparison is that Flexperks wasn’t able to book hotels to many overseas destinations like Rome, Buenos Aires, Melbourne, and other similar locales. Chase had much better access to destinations and more options. With that said, here are a few of the destinations that did compare:

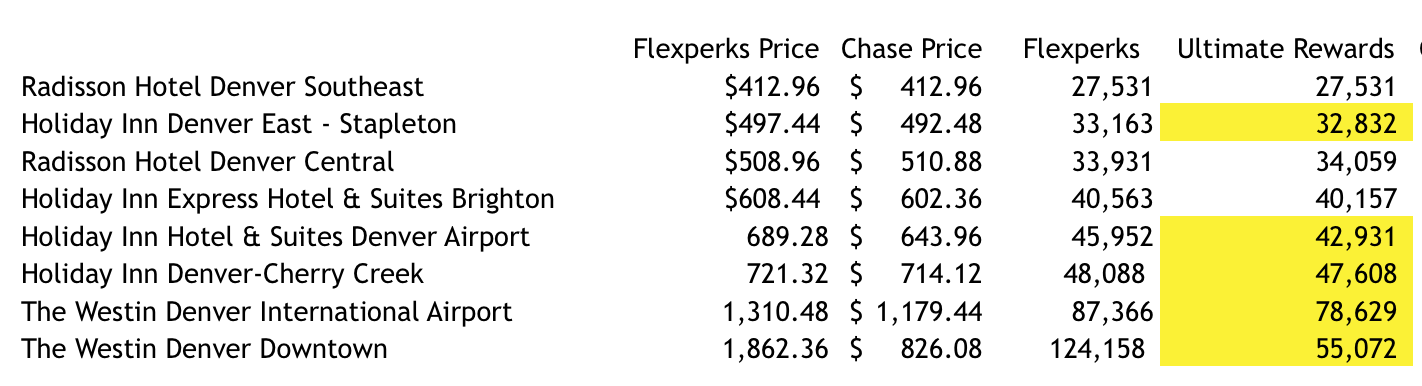

Search 1: Denver Airport (2 months out booking, 4 night stay Monday through Friday)

Result: Chase UR’s were significantly cheaper for most of the searches around the Denver airport.

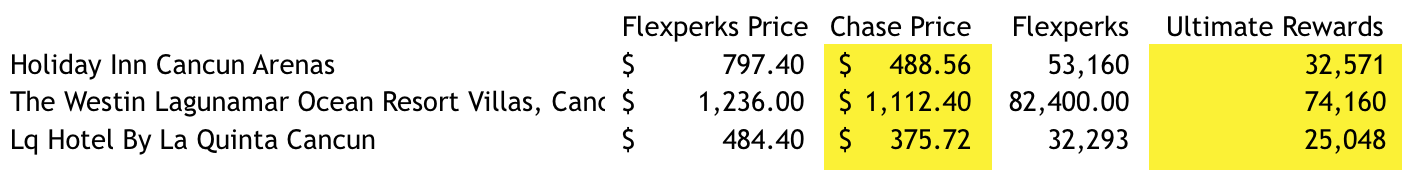

Search 2: Cancun, Mexico (2 months out booking, 4 night stay Monday through Friday)

Result: Similar to the first search, Chase provided the best results for hotels, this time in Mexico.

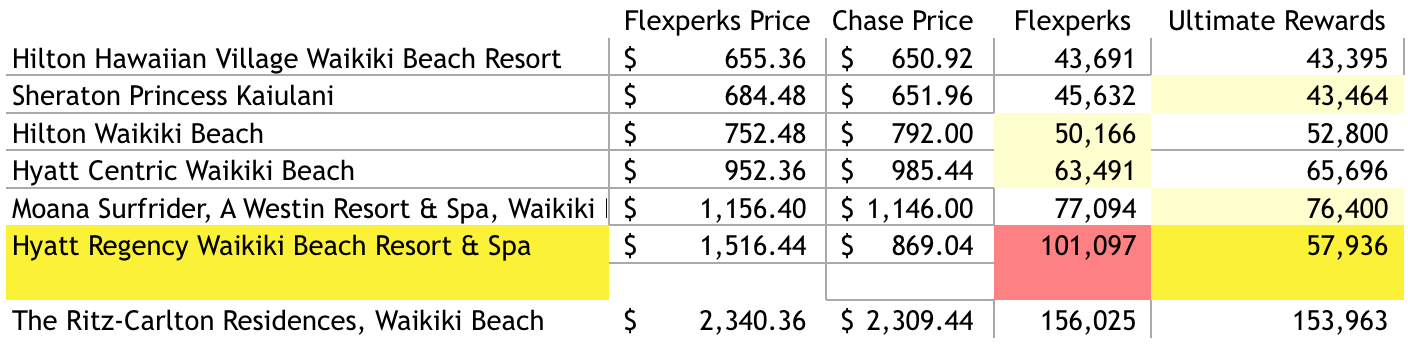

Search 3: Honolulu, Hawaii (2 months out booking, 4 night stay Monday through Friday)

Result: Some mild variations in total points allowed for stays between the two programs, but for the Hyatt Regency in Waikiki, Chase was nearly half the price of Flexperks for the same stay. It was odd to see so much difference, so I had to go back and re-check.

For whatever reason, Chase had dramatically better hotel rates than did Flexperks.

Car Rental

Primary car insurance is offered by Chase via the Sapphire Reserve and Ink Business Plus, and is a huge benefit and value add in my book. I’ve personally used that insurance on many trips overseas, and will continue to do so. Even paying a bit extra for a rental in order to get that insurance for a trip is worth it for me.

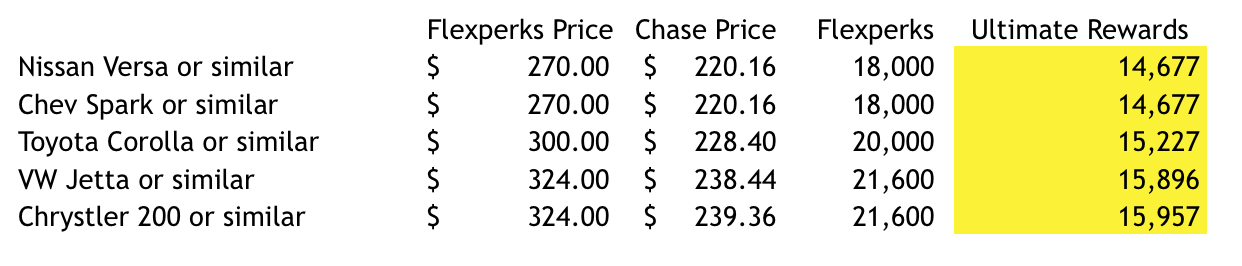

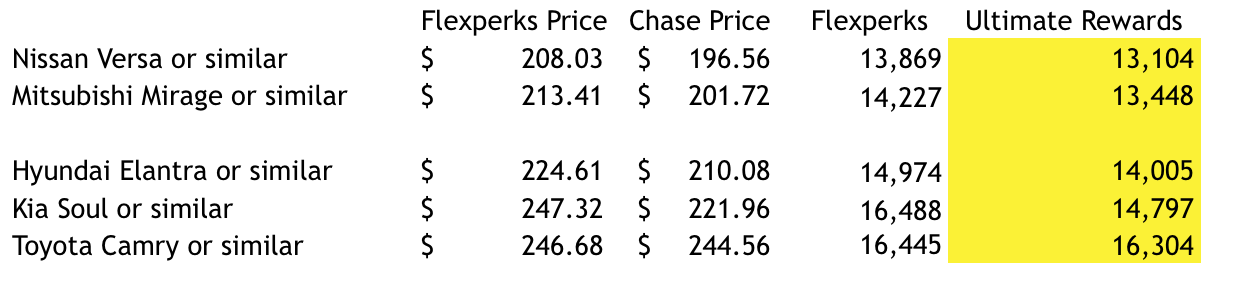

Example 1: Portland (rental 2 months out, 4 days rental Monday through Friday)

Hertz

National Car Rental

Result: Car rental award prices for Flexperks were higher in every test city that I tried.

Summary

Flights seem to offer competitive rates between Flexperks and Ultimate Rewards booked at 1.5 cpp. If you do hold the U.S. Bank FlexPerks Travel Rewards Visa Signature Card and Chase Sapphire Reserve, I’d advise looking at both options before making a flight reservation. However, with hotels and car rentals, Chase seems to offer much better deals in general.

I downgraded my Chase Sapphire Reserve into a Freedom Unlimited several months ago, so this isn’t an option for me anymore. I can book UR’s at 1.25 cpp with the Ink Plus Business that I have, so that makes rates for car rental and hotels more comparable. In general, I don’t book hotels through either Chase or Flexperks, but rather use specific hotel points for stays, use Airbnb, and also stay at hostels/pensions too.