Bling & Splash

Splashy and bling filled redemptions are popular in the points hobby. People seem to love spending large chunks of points on airline first class suites, and apartments topped off with shower’s at 40,000 feet, high end champagne, and intimate service.

A little “splashy” – Business class Cathay Pacific Melbourne-Hong Kong-Los Angeles

In accordance with FIDA (Fairness in Disclosure Act), I like to get splashy with awards every now and then too. For example, I just booked Lufthansa first class back from Europe (Krakow-Frankfurt-Chicago) for myself and a good buddy of mine. Included in the trip are stays with high end Fairmont, Hyatt, and Club Carlson properties. I’ve shelled out over 700,000 points for that trip alone thus far. I also just got back from Australia and Fiji and flew business class there and back, staying in some wonderful hotels in major cities along the way. But those “blingy” redemptions aren’t my norm and have mixed appeal for me. Even with millions of points and miles in the bank, I see super high end redemptions as luxury options which are at times, a pretty big waste of points.

Real Value

Achieving a high cents per point calculated return on an award is great to have, but it’s definitely not everything. Figuring out a cents per point return relies on setting a proper cash value for the flight/redemption. First, I would, or probably never could, actually pay for a $20,000+ flight somewhere or $1,000+ for a hotel night. To add to that, some airlines such as Emirates actually have nice economy seating in it’s larger planes for long distance hauls. Is a paid first class ticket really worth 20x more than the amount charged in coach? I doubt it. But living in luxury, even if it’s only for a day or two at 40,000 feet, is a temptingly blissful feeling. For me though, flights and lodging are more of a means to an end.

A lot of “what if” points scenarios have entered my head lately. One of those thoughts is what would happen if I get shutdown at one or more banks in the near future? The answer is seems pretty obvious: even millions of points/miles could be used quickly, and if there are no other credit card options to replicate/replace earning points in the future, then those banked miles become much more valuable very quickly. Real value for me are the destinations and experiences involved with travel.

Wait for Great

Since I started in the hobby 4.5 years ago, I’ve basically been applying for multiple rewards cards every 91-95 days. Recently that pattern has changed.

I’m currently waiting for a 6 month gap to develop between my last credit card application and any new ones. A small factor was the recent slew of Chase shutdowns over the past few months which did create some concern for me. I’m actually paranoid about applying for a new Chase card right now. The main reason for my wait though is to improve my chances in getting the Capital One Venture Rewards card.

At this point you might be thinking….Capital One Venture Rewards?

Jaws

I have been cage diving with great white sharks in South Africa and a few months ago in Australia. Each of those excursions was paid for completely with around $4,000 worth of Barclays Arrival miles. Unfortunately my Barclays account was shutdown in late 2017 (due to my errors), and I don’t have bank points that could help pay for a future shark dive – this time in Guadalupe Island, Mexico.

https://www.youtube.com/watch?v=8raLJHzWqVA

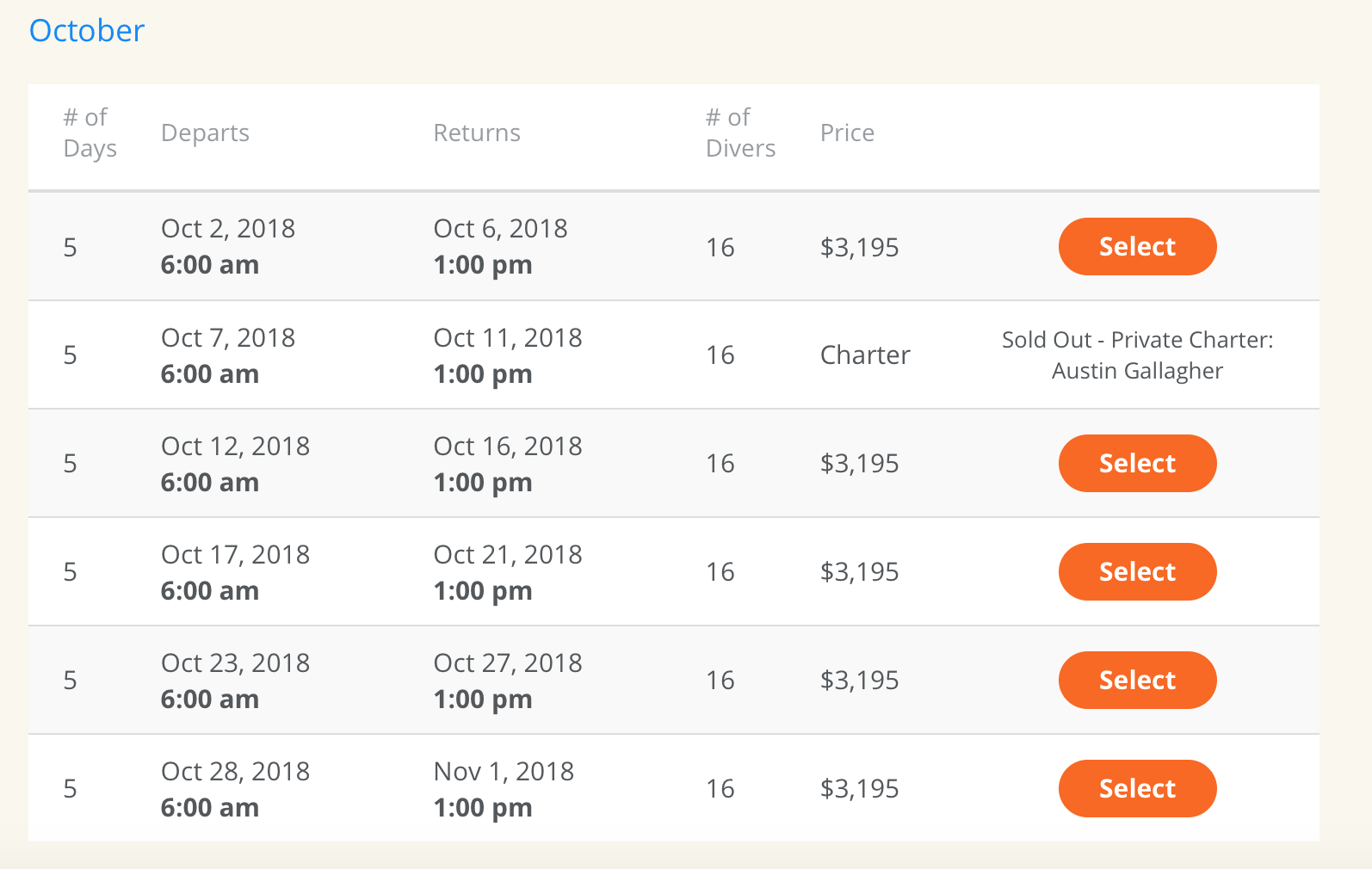

For a 5-6 day cage diving trip around Guadalupe Island, the average cost the trip looks to be around $3,000 to $5,000 USD. That’s not cheap but the experience is incredible and includes transport, lodging, food, scuba gear, and the chance to get up close and personal with great white sharks in some of the clearest water in the world. Believe it or not, cage diving with great white sharks is my primary driving for in my next round of rewards credit cards.

Typical pricing for a multi-day cage diving trip in Mexico. Bank points from Barclays would help!

Risky Business

There’s some risk involved in my Capital One decision to fund my next great white shark adventure. The risk doesn’t involve getting in the water with large sharks, it’s that the actual transaction cost may not be coded as travel. If that’s the case, a special request to use points to pay for the trip may need to be made. Unfortunately a special request might entail some eyes on the account, and if there’s MS associated with the account, then that’s a flashing red light as a special request for charges to be paid for with points is also how my Barclays account was closed. A Capital One shutdown seems to be for life too, so that’s a substantial loss.

However, it’s a risk I’m ultimately willing to take.